2021 - The Whopper Year of Canmore Real Estate

The title is giving it away…. 2021 was a record-breaking year in Real Estate in so many ways:

> Highest Absolute Prices

> Highest Price Increases

We have had positive numbers in every market segment and over every category except for one:

> Lowest number of listings ever!

And that’s a real concern for the many buyers that have been trying to get a foot into the Canmore market but couldn’t. But let’s take a look at the sales numbers first and then look at listings at the end of this report when we cover the Outlook for 2022.

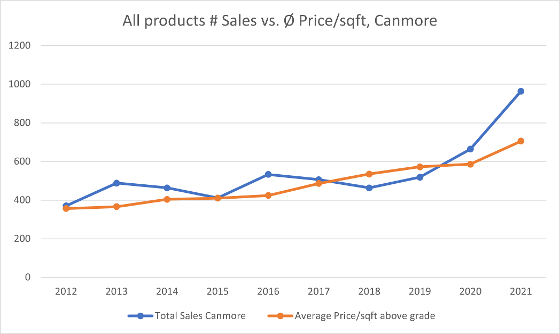

The graph shows yearly sales numbers in Canmore since 2012 in blue and an impressive increase in sales numbers of 45% in 2021 over 2020. The orange curve reflects how the average price/sqft increased by 20% to $705/sqft over the last year.

A closer look at the years 2019 (the last year before Covid) until 2021 shows how sales came to a low point in April of 2020 (orange line) only to reach record levels during the 2nd half of 2020 and far into 2021 (gray line). November 2020 and December 2021 saw the presales of new hotel condo developments in Canmore which led to over 100 sales in those months.

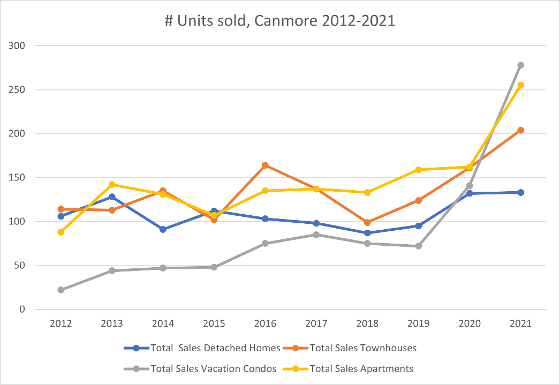

Compared to 2020, we saw the following sales numbers in 2021:

All products: 964 (+45%)

Detached: 133 (+1%)

Townhouses: 204 (+26%)

Hotel Condos: 278 (+93%)

Apartments: 255 (+56%)

Prices

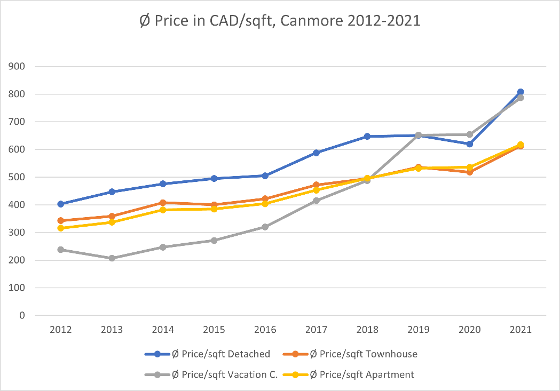

Prices in Canmore in 2021 have increased over all categories. And while price increases for Townhouses and Apartments were a linear line and reflecting a more or less steady increase of 6% and 8%, prices for detached properties really took off, closely followed by Hotel Condos.

Detached

While the average sale price of a Detached in Canmore was $1,162,000 in 2020, it was $1,535,000 in 2021 which is a 32% price increase. This is reflecting the lack of inventory and the continuous increase in demand. Since the beginning of Covid there is still a high desire for people to move from the City to Canmore and work from home.

To work from home, people need more space for the extra office. In general, instead of going out, people still spend more time at home and need space to pursue their hobbies from home (gardening, gym, music room, etc.).

A detached is the most desirable solution.

On the other hand, there is limited space in Canmore. With mountains to the North and South and Banff National Park in the West there is not much space for development. Except for the Three Sisters Area in the East there are no major areas where detached properties are being developed. With the Town of Canmore Council’s decision to put a stop on the Three Sisters Mountain Village and Smith Creek projects there is no higher supply in sight in the near future.

Hotel Condos

Hotel Condos are units within a hotel development. Each unit is owned privately, and owners have the possibility to use the unit for themselves only or enter them into a hotel rental pool, rent them out themselves on Air B&B/VRBO etc. or a combination of both. Since private rentals via Air B&B have become a possibility in Canmore a few years back, those units have become extremely popular.

The average sale price for a hotel condo in Canmore increased from $527,000 to $646,000 in 2021 which is a 23% increase (these prices incl. 5% GST). Part of this price increase could be the fact that since the beginning of the year more lenders have entered the market that are willing to lend on hotel condos. Whilst financing was extremely challenging before and most buyers had to be cash buyers or used a line of credit, it has now become possible to purchase a hotel condo with min. 20-35% down payment. This created demand for bigger and more expensive rental properties with a better return on investment as they were suddenly more affordable.

Average sale prices for Townhouses increased from $740,000 to $784,000 (+6%).

Average sale prices for Apartments increased from $579,000 to $623,000 (+8%).

Here is how the price/sqft changed in the various market segments:

Again, it is the detached properties and the Hotel Condos which saw on average the biggest price increase/sqft followed by townhouses and apartments.

Detached: $808/sqft (+30%)

Hotel Condo: $787/sqft (+20%)

Townhouses: $613/sqft (+18%)

Apartments: $618/sqft (+15%)

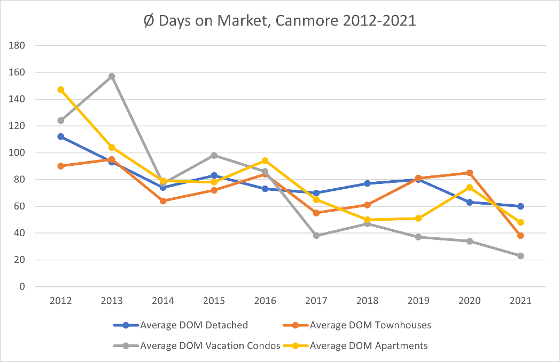

Days on Market

As to be expected, the days on market have decreased in all categories.

The relatively high number for detached properties is due to the months January and December. Unlike with vacation properties or smaller apartments, to move a house is a bigger task and people are usually hesitant to move over Christmas and the cold Winter months. And it is a tough decision to buy a house when you don’t know what you are getting when it is snow covered. Days on Market in the middle of the year were below 30 days.

In general, it was a stressful market for buyers and sellers which required to be well prepared, make quick decisions and not to be afraid to go into competing offers of which we saw a lot last year.

Listings

This brings us to the number of listings and the Outlook for this year. As mentioned at the beginning, we have seen another year of decreasing properties for sale which is the major driver for increasing prices.

We started to fall below the 50 listings mark in October last year and have not come back yet.

As I am writing this article on Jan. 14th 2021, we have for Canmore only 51 active listings:

8 Detached (only 2 below $2 Mio.)

7 Townhouses (only 2 below $1.4 Mio.)

13 Apartments (incl. 7 Tourist Homes)

18 Hotel Condos (incl. 3 Fractionals and 6 properties over $1Mio.)

5 Lots (all above $1.4 Mio.)

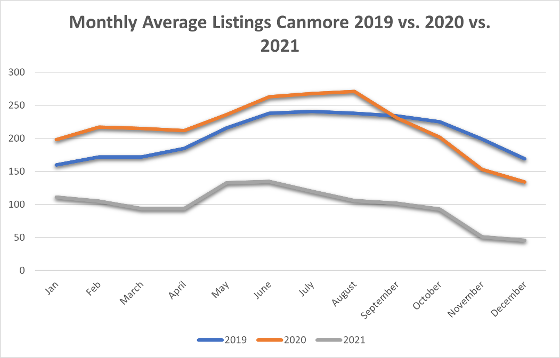

Over the years we have seen a constant decline in listings in Canmore.

Outlook

The burning questions on everyone’s mind is what will happen with Real Estate in Canmore this year and in the future. The last 2 years have been extremely unpredictable and with international economies being so volatile these years it is hard to predict what the future will bring.

In general - not considering present market data - I think Canmore is still a great place to invest. And here especially investments that include land. As we mentioned further up, land is scarce in Canmore.

In 2020 / 2021 the Canadian government brought on the way a huge Covid Relief Program. At the beginning of 2022 inflation rates are up and there is fear of further inflation pressure. Monetary tightening is a proven and reliable policy to counter inflationary pressure.

Interest rates have started to increase and are now at 2.69 – 3%. The government with its monetary policy is trying to carefully balance economic development and inflation rate. A further increase of interest rates is expected in the 2nd quarter of this year, latest by the middle of the year. Bank clients quite often can still lock into lower interest rates for 120 days.

Consequently, I would still anticipate a very tight market for the next few months until May or so when we will see a seasonal relief with more properties coming to market but also with higher interest rates leading to a little less pressure on the demand side.

And whilst we are presently struggling with a huge number of infections due to the Omicron Variant, I think there is also the realization in most of the population that with a proper vaccination protection even an infection is not the end of the world. I think the realization that Covid could eventually be treated like a regular flu will also ease some pressure in the housing market and there will be more people ready to move.

I believe that there will be those homeowners whose property is now at a peak value who will want to cash out and use the money otherwise. When they sell their townhouse in Canmore, they can now buy a fantastic, detached property in other towns in Alberta.

With prices for vacation properties as high as they are right now, the potential for a good return on investment is limited. Increasing interest rates will further reduce this small margin. Travel restrictions are still in place, and we are still waiting for the regular US travellers to return. Canadian travellers are not willing to pay as much for accommodation as their US and overseas counterparts.

A lot of properties have been presold and will be built over the next 2-3 years. Stronger competition in the Air B&B market will have an additional effect on rental prices. I believe that this market will see more listings coming up as the year matures and that prices will at least level out.

Some buyers will lose interest as the market remains pretty much a sellers’ market with little to choose from.

I believe that overall, 2022 will be a much tighter market with less sales. The second half of 2022 will see higher interest rates leading to less demand as well as some relaxation in the supply sector. The shopping frenzy will slowly fan out.

Thomas Krause – CANMORETHOMAS | REALTOR RE/MAX Alpine Realty

Canmore 15.01.2022