Is the Canmore Real Estate Market starting to recover?

I will keep you posted as soon as the data for June is in!

|

|

1st Quarter 2019 |

1st Quarter 2020 |

|

Average number of listings |

168 |

210 (+25%) |

|

Average list price |

987,000 |

1,089,000 (+10%) |

|

Number of Sales |

99 |

93 (-6%) |

|

Average sale prices |

731,000 |

738,000 (+1%) |

|

|

|

|

March 2019 |

March 2020 |

|

|

Average number of listings |

172 |

215 (+25%) |

|

Average list price |

969,000 |

1,095,000 (+13%) |

|

Number of Sales |

44 |

27 (-39%) |

|

Average sale prices |

755,000 |

771,000 (+2%) |

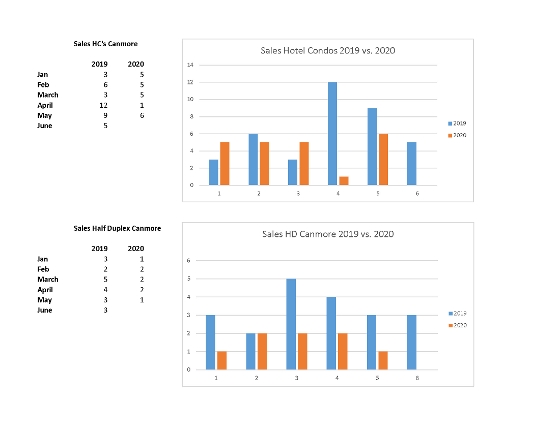

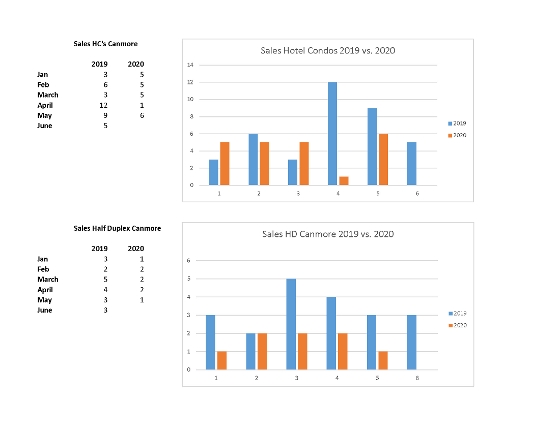

The average Number of Listings in the first quarter of 2020 as compared to 2019 is up by 25%. However March listings are also up by only 25%. >>>> That’s in the average…..there is no further increase of listings as of now. (Note that there are 4 times as many hotel condos listed in the first quarter of 2020 then there were listed in 2019.)

The average List Price of the first quarter of 2020 over the same period in 2019 was up by 10%. The average list price for March was up 13%. >>>> We have not seen...

Dear friends of Canmore,

I am sitting here in my office looking out onto an absolutely stunning Winter wonderland with an incredible blue sky, crystal clear cold air and the sun turning everything bright and golden. What a joy and blessing to be able to live here!

Last year at this time I predicted that Canmore 2019 would see a “stable price level with no or very little price increase and perhaps some more supply”.

I was only partially right: Since 2010, the numbers of listings have been decreasing in Canmore and 2019 is the first year that sees this tendency turn around with a significant increase of supply over 2018 by 20% from 155 listings on average to 186 listings on average throughout the year. This turned only partially into 12% more properties sold in Canmore in 2019 than 2018 (518 Sales). However – average price/sqft above grade still increased by 7% (10% from 2017 to 2018) for the whole of Canmore. The numbers are very different...

New Mortgage Rules starting Jan. 2018

Starting January 1st, 2018 all mortgages will be required to qualify at the posted 5 year rate, or at this time approximately 4.89%. Currently mortgages with 20% or more can qualify at the regular 5 year rate of approximately 3%. The difference can reduce mortgage amounts by approximately 20%.

If you are interested in buying and have not been pre-approved for the new stress test, now might be the time to do so to find out, what the difference would be for you and if you should make a move before the deadline at the end of this year.

Below is a link to the government's website detailing the changes. Feel free to call or email if you have any questions or concerns!

http://www.osfi-bsif.gc.ca/Eng/osfi-bsif/med/Pages/B20_dft_nr.aspx

The Canmore Real Estate Market – Past, Present and Future

The decline of the price of crude oil which started internationally in August 2014 had a huge influence on the economy of Alberta and Calgary. While the price was previously at around $100US / barrel crude oil, the price dropped to its lowest at around $30 in February 2016 and has since started to recover to around $54 US in Dec. 2016.

Alberta’s economy which depends heavily on the oil industry has been hit with unemployment which lead to a negative net migration. People previously employed in the oil industry left Alberta and went back to their home provinces. The spending budget of many of those who stayed decreased sharply.

This development was also reflected in the Real Estate Market. With a lot of properties coming on the market but less people to look for properties, the Sales Volume in Calgary declined in Nov. 2016 by 3% year over year and was down by 17% when compared to long-term averages. Sales Prices decreased...

People have been stopping me on the street, asking what "I Champion Your interests!" is all about. Hear it from a spot by radio 106.5 Mountain FM, our local Canmore Radio Station:

Five things to watch after the Bank of Canada's latest rate cut

The decision that practically gripped the nation came down this morning, as Bank of Canada Governor Stephen Poloz decided to cut interest rates once more. The first of his cuts came more abruptly when in January of this year, the BoC shaved 25 basis points off what was thought to be a stable 1 per cent; it was the first rate cut since April, 2009, and was a direct response to the steep drop in oil prices.

Wednesday's rate cut to 0.5 per cent was less of a surprise as the economy has not rebounded as the central bank expected. Now, not only did the BoC cut its rates, but it dramatically lowered its growth projections for the rest of the year.

Below are five things to watch out for after the interest rate cut.

How will the banks react?

The question now is whether the banks will follow suit and cut their own prime rates in response to the rate cut - and by how much. Toronto-Dominion Bank was the...