At first glance, the Canmore real estate market in 2025 seems to break one of the most basic rules of economics:

Sales are down — yet Prices keep rising.

In a typical market, lower sales numbers signal weaker demand, eventually leading to price corrections. But Canmore is not a typical market. To understand what really happened in 2025 — and what it means for buyers and sellers looking ahead to 2026 — we need to look beneath the surface.

Let’s break it down.

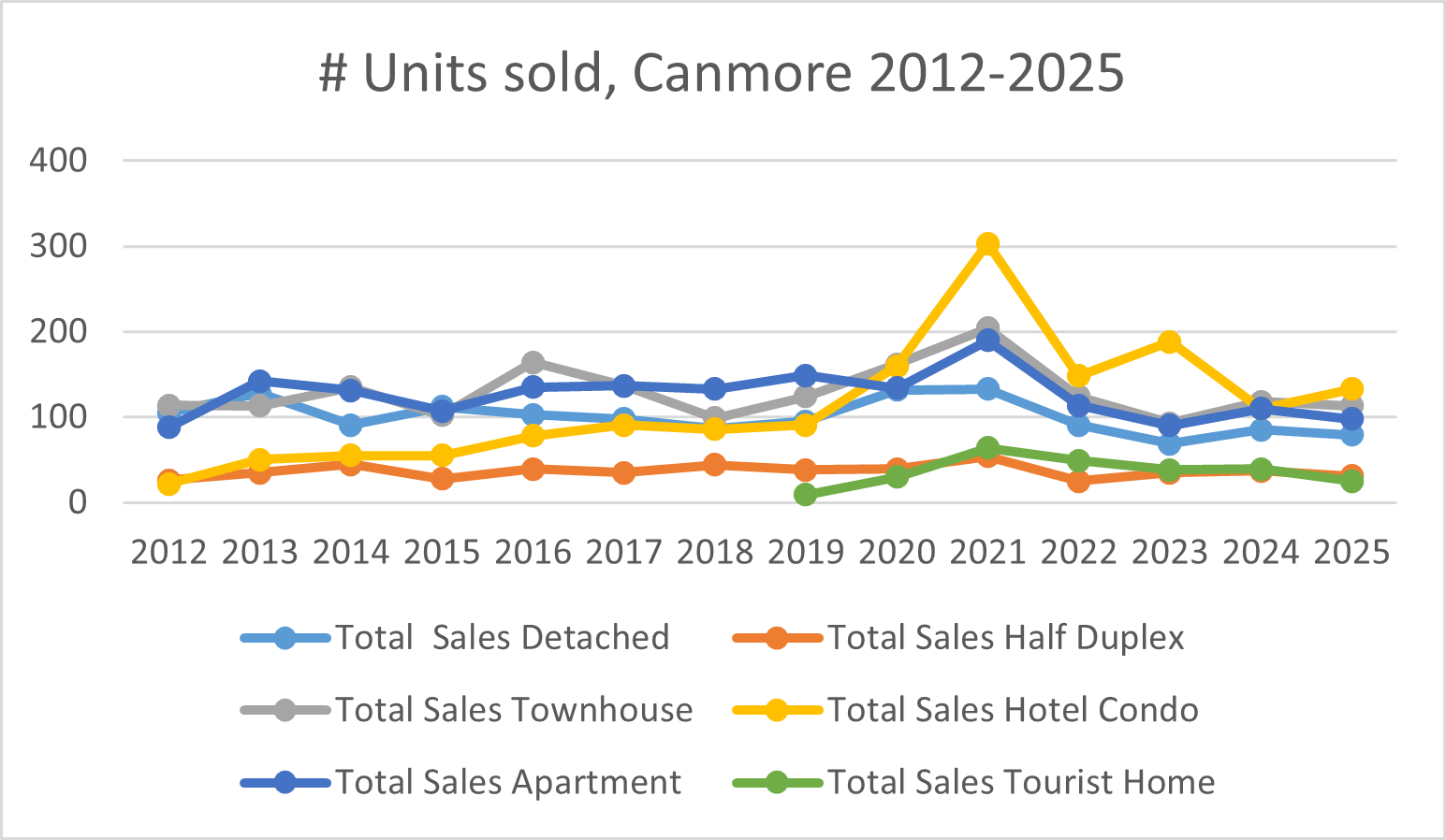

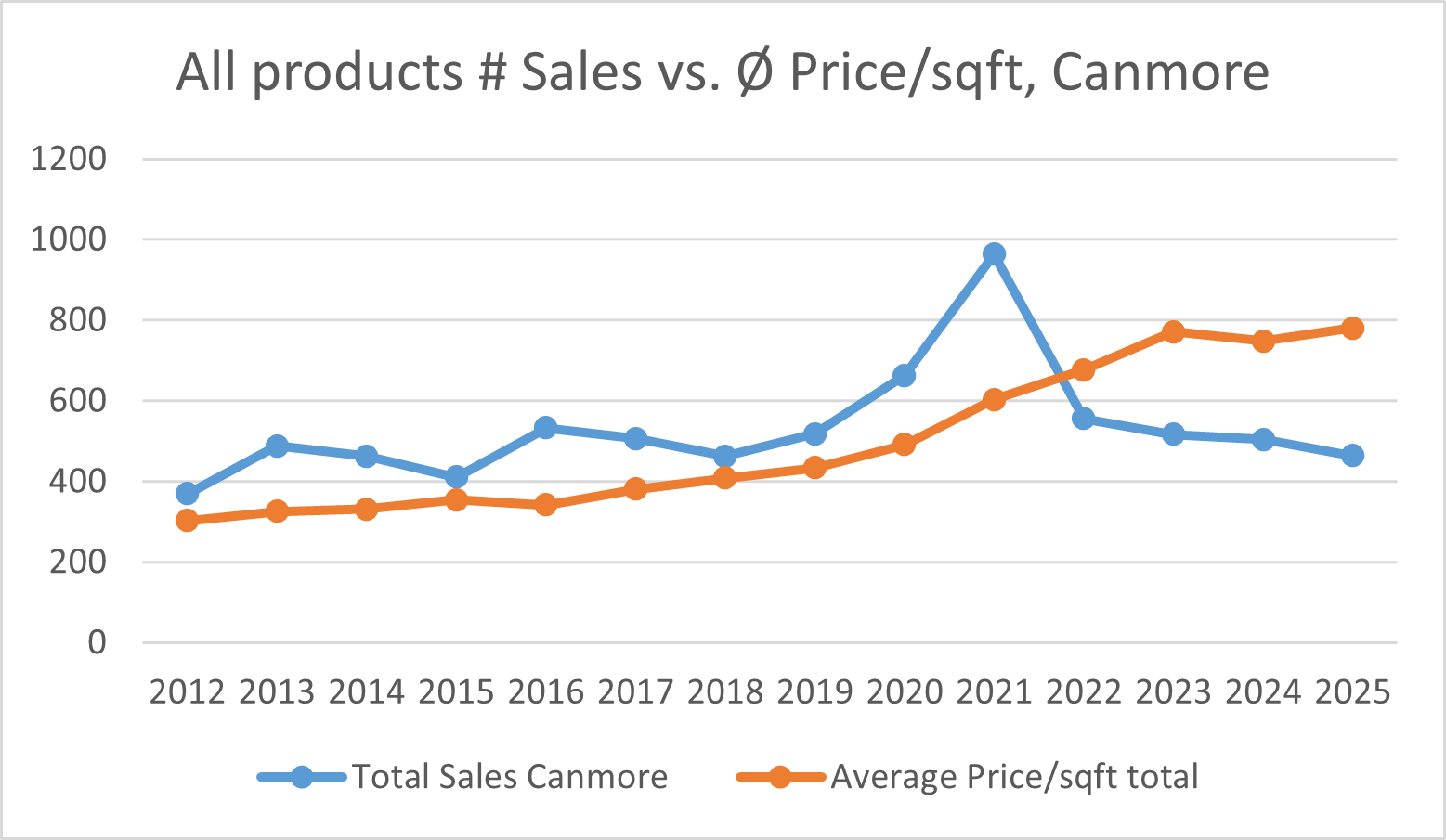

In 2025, Canmore recorded 483 property sales, down from 504 sales in 2024 — a decline of roughly 4%. If that sounds familiar, it should: 2024 already saw a similar 4% drop compared to 2023. This marks the second consecutive year of declining sales volume.

However, the reasons behind the decline shifted.

In 2024, lower sales were largely driven by a slowdown in Hotel Condo transactions. In 2025, the picture changed: sales declined across most property types — except Hotel Condos, which saw a notable rebound.

Sales change by property type (2025 vs. 2024):

Detached Homes: –7%

Half Duplexes: –16%

Townhouses: –4%

Apartments: –11%

Tourist Homes: –36%

Hotel Condos: +21%

Why Hotel Condos Stood Out

Resale activity for Hotel Condos was essentially flat — 61 resales in 2024 versus 63 in 2025. The increase came almost entirely from new development sales, primarily the Grizzly Ridge project.

In total, 70 new Hotel Condo units sold in 2025, compared to only 47 units in 2024. With a planned construction timeline of roughly two years, these units are expected to enter the rental market in early 2028, meaning they have little immediate impact on today’s supply.

Inventory: Still Historically Tight

Inventory remains one of the defining features of the Canmore market.

2021 (Covid low): ~99 listings on average

2024: ~107 listings

2025: ~129 listings

At first glance, the increase to 129 listings suggests relief. However, this number includes over 20 apartment units at Industrial Place, many of which have been listed for months while still under construction.

When adjusted for that factor, effective inventory remains very low, especially by historical standards:

2015: ~234 listings

2010: ~500 listings

Simply put: Supply is still nowhere near keeping up with demand.

Interest Rates: From Tightening to a Pause

Interest rates played an important psychological — and practical — role in 2025.

The Bank of Canada began cutting rates in May 2024, and by early 2025 the policy rate stood at 3.25%. Over the course of the year:

March 2025: 2.75%

September 2025: 2.5%

October 2025: 2.25%

December 2025: held steady

As a result, the prime lending rate fell from over 7% to approximately 4.45%, marking a clear shift from fighting inflation to supporting a slowing economy.

Most economists now expect the Bank of Canada to hold rates around 2.25% through much of 2026, with some forecasting modest increases later in the year, depending on inflation, economic growth, and U.S.–Canada trade relations.

This “pause” in rate cuts has proven important: many buyers who were waiting for much lower rates are now realizing that those levels may not return anytime soon.

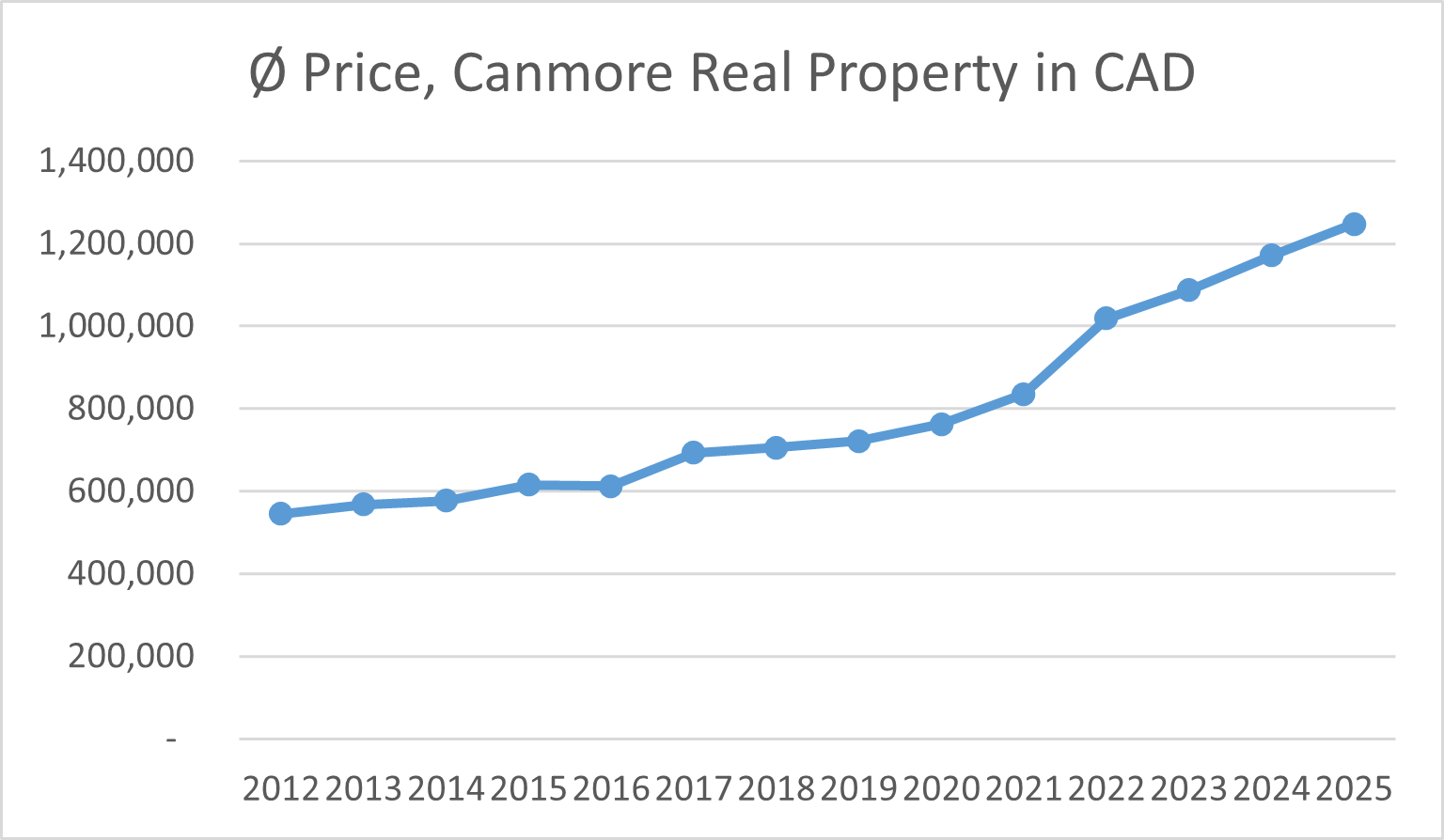

Prices: Still Rising, But More Nuanced

The average sale price in Canmore in 2025 reached $1,247,000, a 6.5% increase over 2024.However, properties sold in 2025 were also larger:

2024 average size: 1,564 sq ft

2025 average size: 1,597 sq ft

As a result, the price per square foot increased more moderately:

2024: $749 / sq ft

2025: $781 / sq ft

→ ~4.3% increase

Over the longer term, the trend remains clear: Canmore prices have more than doubled over the past 10 years.

Detached Homes

Average sale price: $2,154,000 (↑ ~8%)

Price vs. list: ~3% below asking

Average size: 2,814 sq ft

Price per sq ft: $765

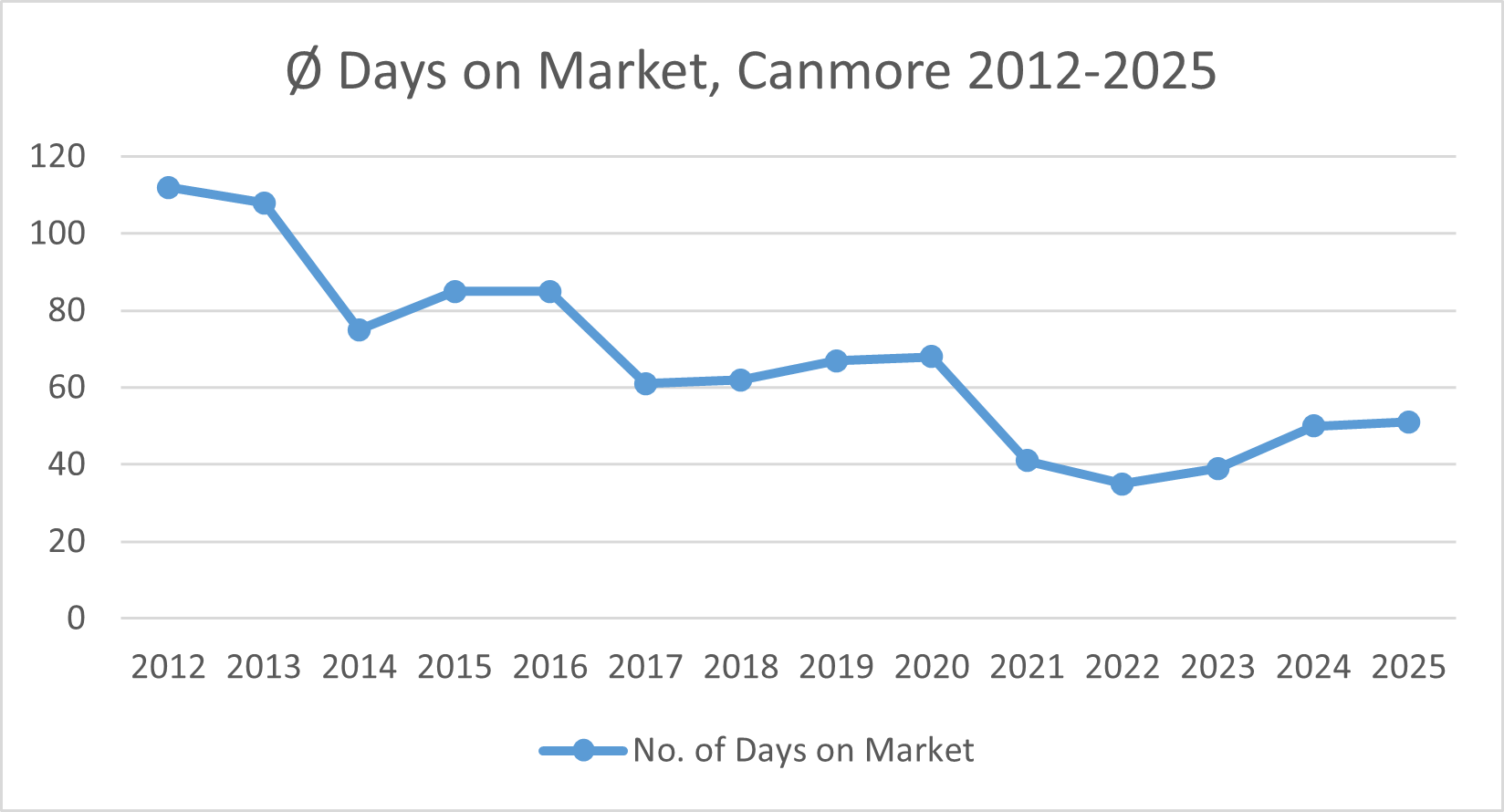

Days on Market: 70 days (up from 56)

Detached homes took longer to sell, but pricing remained strong — a sign of selective, not weak, demand.

Half Duplexes

Average sale price: $1,923,000 (↑ ~16%)

Price vs. list: ~1% difference

Days on Market: 56

Price per sq ft: $704

The strong price increase was driven largely by new duplex developments, where buyers showed little resistance to asking prices.

Townhouses

Average sale price: $1,147,000 (↑ ~8%)

Average size: 1,711 sq ft (↑ 7.5%)

Price per sq ft: $670 (almost unchanged from 2024)

Days on Market: 58

Here, higher prices were primarily driven by larger unit sizes, not rising price pressure per square foot.

Hotel Condos: A Market of Its Own

Hotel Condo pricing in 2025 was heavily influenced by presales, which need to be viewed separately from resales.

Average sale prices:

Overall: $978,000 (incl. 5% GST)

Resale: $944,000

Presale: $952,000

(Main Street development: ~$1.7M)

Price per sq ft:

Overall: $1,166

Resale: $1,064

Presale: $1,224

(Main Street: $1,558)

Although presale prices appear only marginally higher than resales, presale units are significantly smaller, resulting in ~17% higher price per square foot.

For short-term rentals, size has historically mattered less than layout and bed count. However, as new units become increasingly compact, larger resale units may turn into a competitive advantage on Airbnb.

Days on Market:

Overall: 24 days

Resales: 39 days

Presales: 2 days

Apartments

Average sale price: $814,000 (↑ ~8%)

Price vs. list: ~1.8% below asking

Average size: 1,095 sq ft

Price per sq ft: ↑ ~6%

Days on Market: 54 (up slightly)

Buyer competition remained strong, leaving little room for negotiation.

Tourist Homes

Average sale price 2025: $960,000

2024: $1,221,000 (inflated by new fourplex sales)

2023: $902,000

Viewed over two years, prices are up ~6%, with an average of $1,000 per sq ft.

Politically, this segment faces uncertainty. The government is phasing out Tourist Home zoning and encouraging owners to convert units to residential use, which offers tax advantages but removes short-term rental rights.

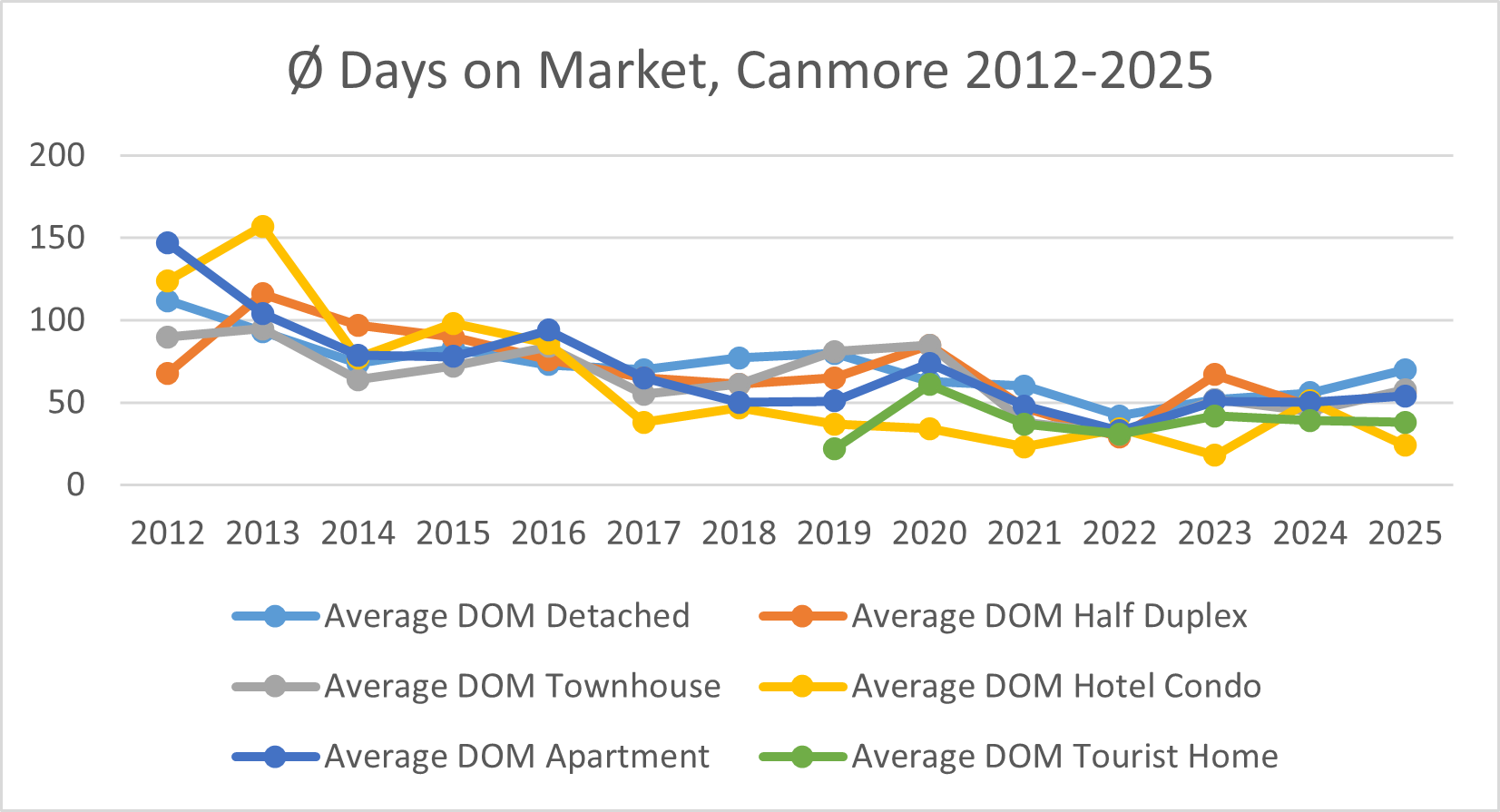

Inventory & Days on Market: Still a Buyer’s Constraint

Detached: 70 days (+14)

Townhouses: 58 days (+13)

Duplexes: 56 days (+8)

Apartments: 54 days (+4)

Hotel Condos (resale): 39 days (↓ from 51)

Tourist Homes: ~38 days (unchanged)

While Days on Market increased slightly across most property types, inventory remained the dominant constraint: Even with longer selling times, buyers still face limited choice.

Conclusion: Why Canmore Remains One of Canada’s Most Resilient Markets

Canmore’s popularity as a world-class mountain destination continues to grow — and that popularity translates directly into housing demand. Many owners are content to hold, limiting resale supply, while new developments simply cannot keep pace.

The Town of Canmore’s proposed vacancy tax, originally scheduled for 2026 and now under revision, may eventually apply only to non-Albertans. So far, it has not led to increased selling, and its long-term impact remains uncertain.

At the federal level, the Foreign Buyer Ban is set to expire at the end of 2026. Many international buyers — particularly from the U.S. — are already positioning themselves for entry. If the ban is not extended, 2027 could see renewed demand pressure.

Broader risks remain. Trade tensions, tariff threats, and an increasingly unpredictable U.S. foreign policy environment pose challenges for the Canadian economy as a whole. Yet among Canadian real estate markets, Canmore has consistently proven to be one of the most resilient.

If economic headwinds are managed successfully, the outlook for 2026 is constructive:

prices likely continuing to rise

sales volumes stabilizing or improving

motivated buyers re-entering the market before rates move higher again

For both buyers and sellers, the message is clear: Canmore continues to reward those who plan ahead rather than wait on the sidelines.

If you have any questions about this report or the Canmore real estate market, are curious about the current value of your property, or are considering taking your first steps into the Canmore market, feel free to reach out. I’d be delighted to assist you!

Stay informed, stay prepared, and let’s make the most of what Canmore has to offer in the year ahead!

Happy New Year 2026!

All Data taken from Interface, Canmore only

The data and statistics presented in this report are based on available sources and are deemed reliable but cannot be guaranteed for accuracy or completeness. They are intended for informational purposes only and should not be solely relied upon for making financial or real estate decisions. Always consult with a qualified professional for personalized advice.

#livabilitytax, #touristhome, #touristhomeprogram, #housingcrisis, #HousingCrisisSolution, #canmoretax, #canmoretaxprogram, #livabilitytaskforce, #livabilitytaxprogram, #touristhomepersonalusetax, #shorttermrental, #canmorelicencing, #canmore, #homevalue, #marketupdate, #canmorehomeprices, #canmorehomes, #canmorerealtor, #canmorethomas, #canmorerealestate, #realestate, #realestateagent, #realestateinvesting, #realestatetips, #realestateinvestor, #realestateinvestment, #realestatemarket, #realestatenews, #canmorenews, #canmoreab, #albertarealestate, #realestateab, #alberta, #canmorealberta, #canmoreliving,