We are almost half a year into 2025. In the US, President Trump moved into office in Jan. 2025 again and in Canada Prime Minister Carney was sworn in in March 2025. In June 2024 the Bank of Canada started to drop its key interest rate in small steps from then 5% to 2.75% in March 2025 where it has been sitting since. What effects did this have on the Canmore Real Estate market – what happened so far this year and what’s coming….

In short:

Sales Numbers are down

Numbers of Listings are up

Prices are up

We are looking at a more balanced market with more inventory and less demand….buyers are cautious….and yet: Prices are up compared to last year.

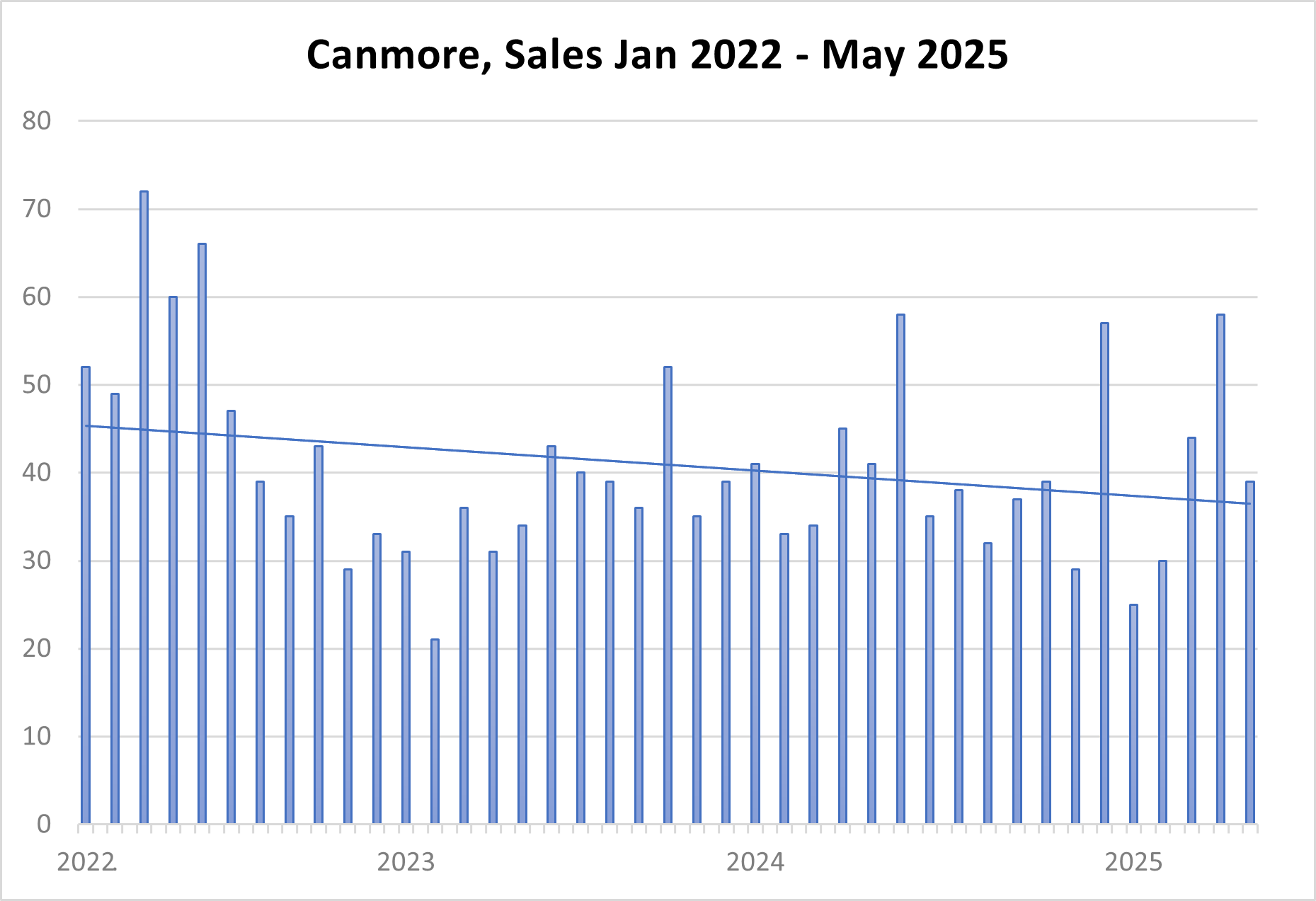

Sales numbers for the first five months of this year decreased by approximately 8% compared to last year. The average number of listings increased by roughly 30%. Average days on market rose from 50 to 55 days this year.

Looking at the long-term trend since 2022, sales figures show a decline: 556 sales in 2022, 515 in 2023, 504 in 2024, and projections indicate fewer than 500 sales for the current year which could be the lowest number since 2019.

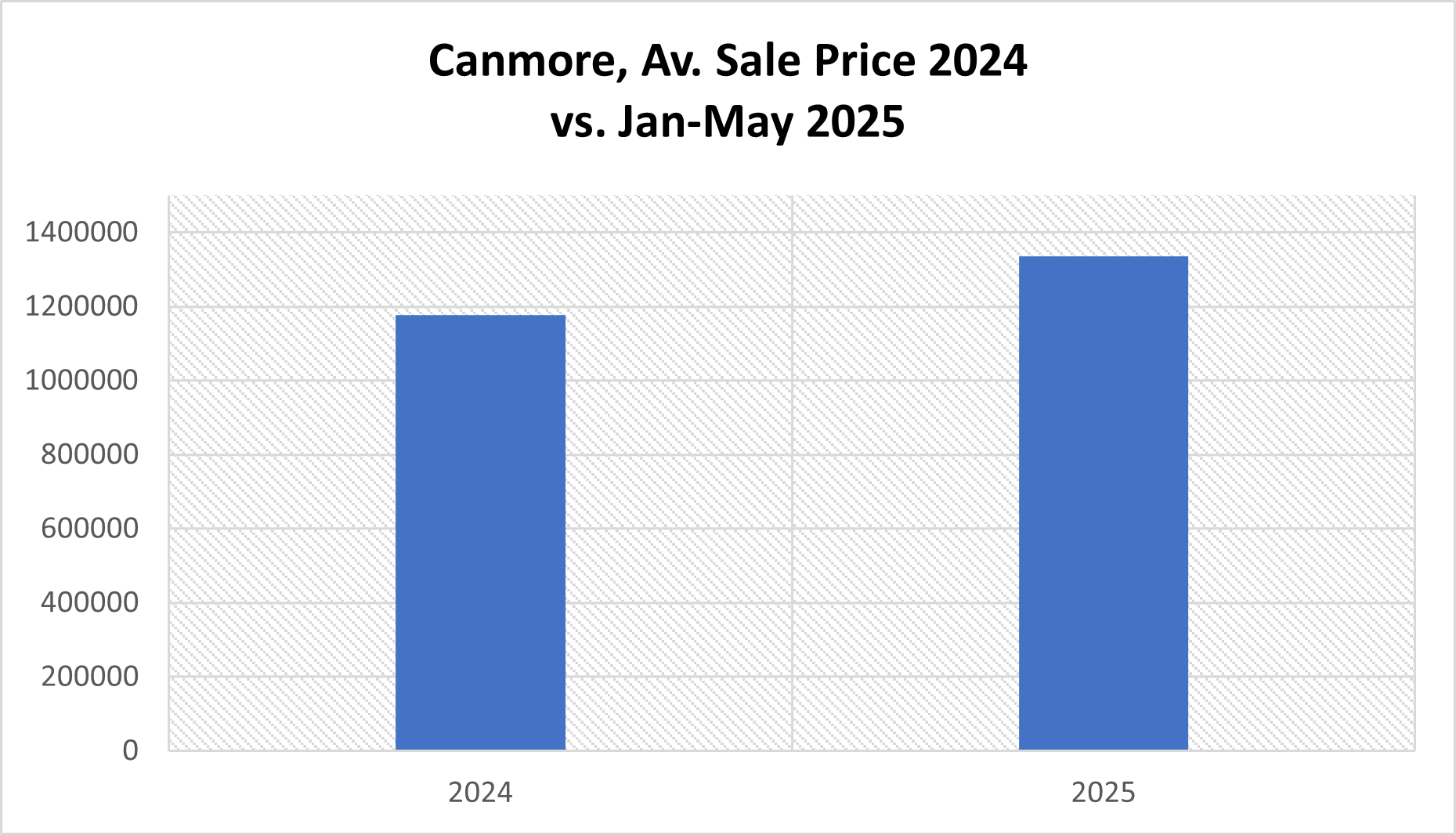

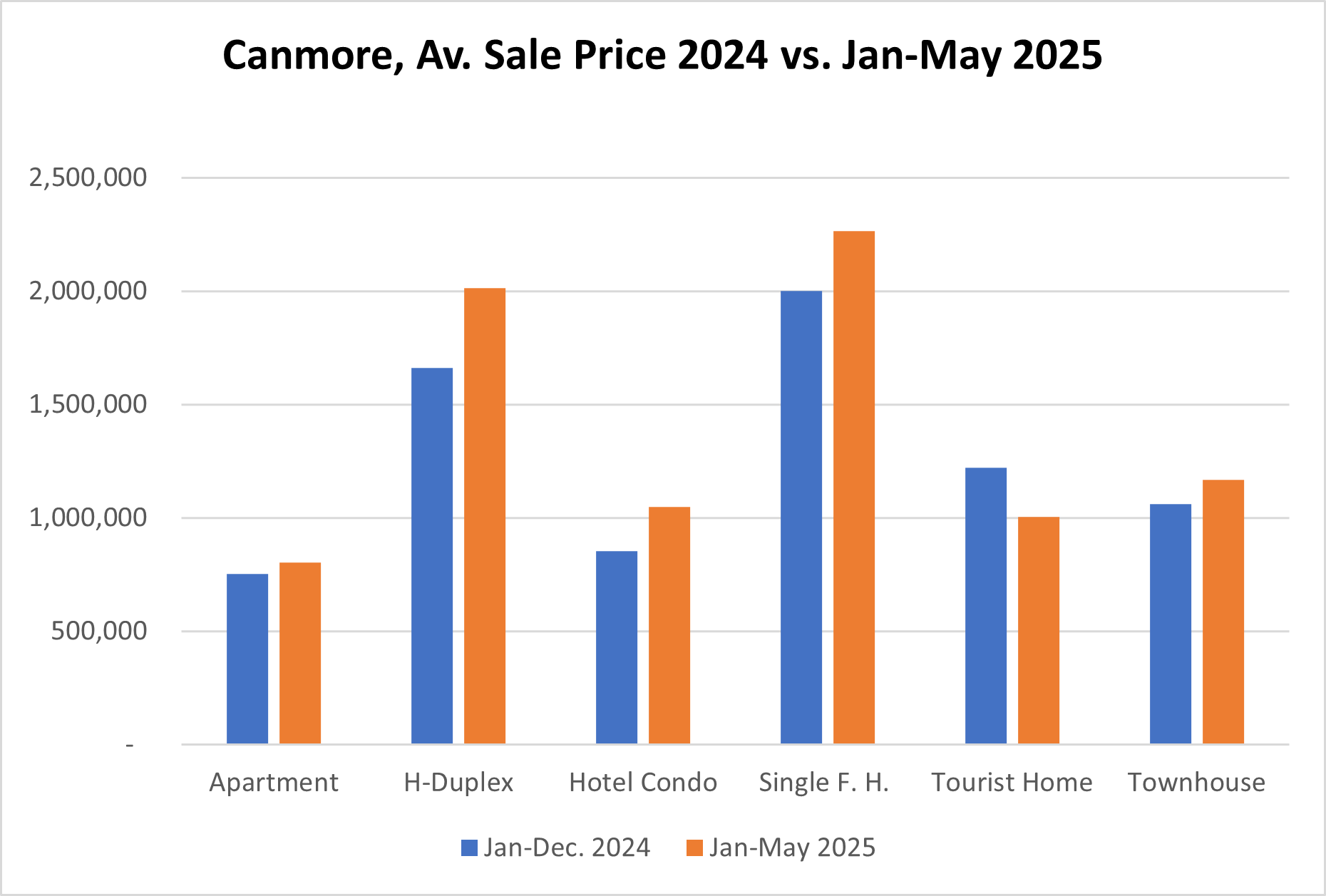

Regardless of the slight drop in sales numbers, prices continued to rise for Canmore this year. Whilst the average sale price in 2024 was below $1.2 Mio, the average sale price of properties sold during the first 5 months this year was over $1.3 Mio. An increase of about 14%.

Average sale prices increased for all categories except Tourist Homes. (The Tourist Home category recorded untypical high sales prices last year for brand new developments at Spring Creek and Teepee Town).

What’s the Outlook for This Year?

The trade war with the U.S. has taken a toll on consumer confidence and slowed down business investment. Still, Canada managed to avoid the worst so far. President Trump has eased up on some of the harsher tariffs and made exceptions for important sectors, like auto parts manufacturing.

Earlier this week, the Bank of Canada kept its key interest rate at 2.75% for the second time in a row. They hinted, though, that if the pressure from U.S. tariffs continues, they might have to cut rates to help support the economy.

This comes on the heels of stronger-than-expected inflation and solid economic growth in the first quarter—signs that the effects of Trump’s trade war haven’t hit too hard just yet. Still, the Bank expects the second quarter to be “much weaker.”

Where things go from here—whether rates rise or fall—largely depends on how the tariff situation plays out.

For now, with no change in interest rates, there’s not much relief in sight for the housing market. Many potential buyers are holding off, uncertain about the economy and wary of higher borrowing costs.

Trump’s unpredictable foreign policy, paired with these elevated rates, is creating a lot of uncertainty—something that never helps a market. And Canmore’s real estate scene is feeling it too.

If rates come down later this year—especially if they drop by a full percentage point—we could see the market pick up considerably.

What happens next really hinges on upcoming trade talks between Trump and Prime Minister Mark Carney. If Canada can secure a clearer, more stable trade agreement with the U.S., that could help restore confidence. And when people feel confident about the economy, they’re more likely to spend—giving the housing market a much-needed boost.

Other factors influencing sales numbers in Canmore are:

Prohibition on the Purchase of Residential Property by Non-Canadians

The Prohibition on the Purchase of Residential Property by Non-Canadians Act is a federal restriction that remains in effect across Canada until the end of 2026. Under this law, only Canadian citizens and permanent residents are permitted to purchase residential real estate, with limited exceptions.

Initially introduced in January 2023 as a two-year measure, the ban was extended for an additional two years. In markets like Canmore, this policy has notably reduced demand—particularly from international buyers, including many Americans who have traditionally shown strong interest in the area.

Canmore Livability Tax

The Livability Tax is a new levy targeting vacant homes, expected to generate around $10 million in revenue. These funds will be set aside to support the development of social housing in Canmore.

The tax applies specifically to properties owned by individuals who do not list a Canmore address on their driver’s licence or personal income tax return, and who do not reside in Canmore for at least 183 days per year (including a minimum of 60 consecutive days).

This additional tax will amount to 0.4% of a property’s assessed value. Based on the 2025 residential mill rate and an average home price of $1.3 million, non-resident owners of vacant homes would end up paying roughly double the property tax of full-time residents. The mill rate would effectively increase from 4.66981 ($4.66981 tax per $1,000 assessed value) to 8.66981 for these properties.

Although the Town of Canmore originally planned to implement the Livability Tax in 2025, a court ruling has delayed its introduction until 2026.

This could be a turnoff for 2nd homeowners looking for a vacation home. As of 2023 about one-quarter of 9,100 dwellings were owned by non-Canmore residents.

So Why Are Prices Still Going Up in Canmore?

There are two main reasons. Unlike many other real estate markets, Canmore isn’t primarily driven by the general economy—it’s heavily influenced by lifestyle and leisure. People don’t typically move to Canmore for work; they come to enjoy the mountain lifestyle, to retire, or to escape the city. That kind of motivation tends to be more resilient in the face of broader economic uncertainty.

The second factor is investment. Buyers looking for a vacation property—or simply a place to park their money—often see Canmore as a hedge against inflation. Property values here have steadily climbed over the past decade, and there’s no real indication that this trend will reverse anytime soon.

Even when the Canadian economy faces pressure, Canmore continues to stand out as a stable, desirable place to invest

Some of the smaller contributing factors could include returning Canadians who sold property in the U.S. and are now cash buyers in Canmore, as well as Calgary buyers who may have overpaid—often because they were represented by Calgary-based agents unfamiliar with the Canmore market. With Calgary’s real estate market running hot and highly competitive in the early months of this year, agents from that area may have brought that high-pressure mindset into local negotiations, advising their clients based on Calgary conditions rather than Canmore realities.

Final Thoughts

Canmore’s real estate market in 2025 is showing resilience despite headwinds. While the number of sales is softening, prices remain strong, inventory is increasing, and buyers are navigating a more balanced playing field. The remainder of the year will depend largely on interest rate movements, trade developments, and evolving buyer confidence—but Canmore’s unique mix of lifestyle, scarcity, and stability continues to set it apart.

For all questions around Real Estate in Canmore, contact:

THOMAS KRAUSE B.Comm - Associate | REALTOR ®

RE/MAX ALPINE REALTY

Cell: 403.678.7653

www.canmorethomas.com

#livabilitytax, #touristhome, #touristhomeprogram, #housingcrisis, #HousingCrisisSolution, #canmoretax, #canmoretaxprogram, #livabilitytaskforce, #livabilitytaxprogram,

#touristhomepersonalusetax, #shorttermrental, #canmorelicencing, #canmore, #homevalue, #marketupdate, #canmorehomeprices, #canmorehomes, #canmorerealtor,

#canmorethomas, #canmorerealestate, #realestate, #realestateagent, #realestateinvesting, #realestatetips, #realestateinvestor, #realestateinvestment, #realestatemarket,

#realestatenews, #canmorenews, #canmoreab, #albertarealestate, #realestateab, #alberta, #canmorealberta, #canmoreliving,