As the year draws to a close, Canmore’s unique position as a gateway to the Rockies continues to make it a standout market in Alberta’s real estate landscape. Whether you’re a long-time homeowner, an investor, or someone dreaming of a mountain retreat, understanding the trends shaping our local market is crucial to making informed decisions.

In this report, we’ll explore the key trends from 2023, analyze how 2024 unfolded amidst changing market dynamics, and provide a forecast for what 2025 may hold for buyers and sellers alike. With Canmore’s exceptional blend of natural beauty and vibrant community appeal, the opportunities in our market are as compelling as ever.

Join me as we uncover the insights that will shape your real estate journey in the coming year!

Sales Numbers:

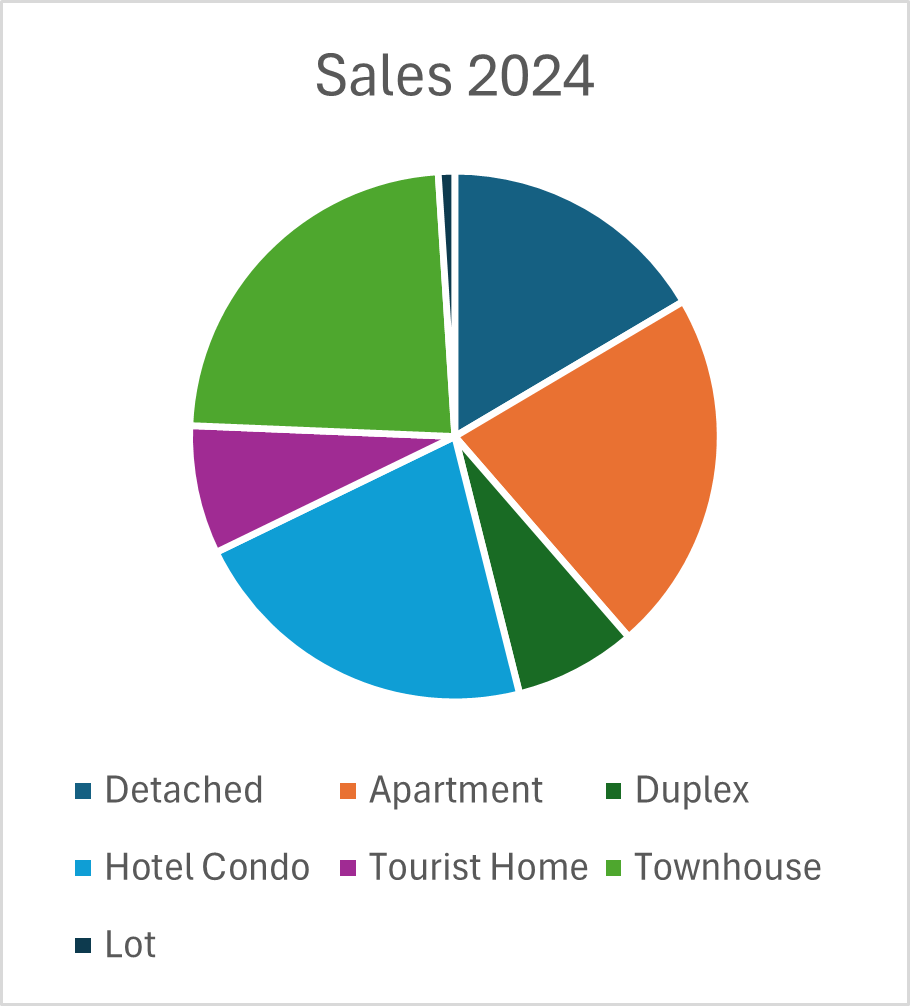

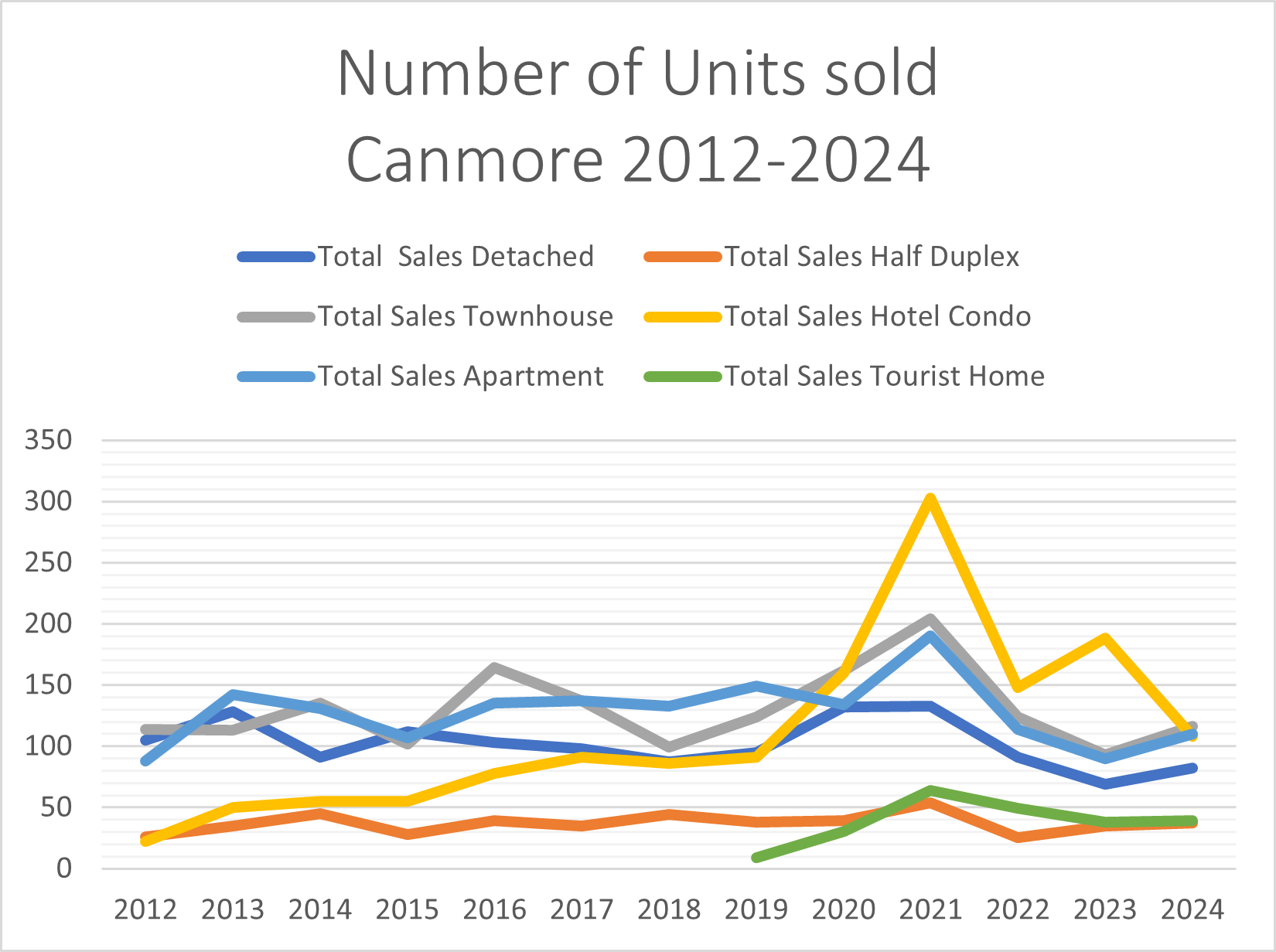

2024 saw a modest 4% decline in total sales compared to 2023 (497 sales vs. 517 sales), primarily due to a significant drop in hotel condo sales.

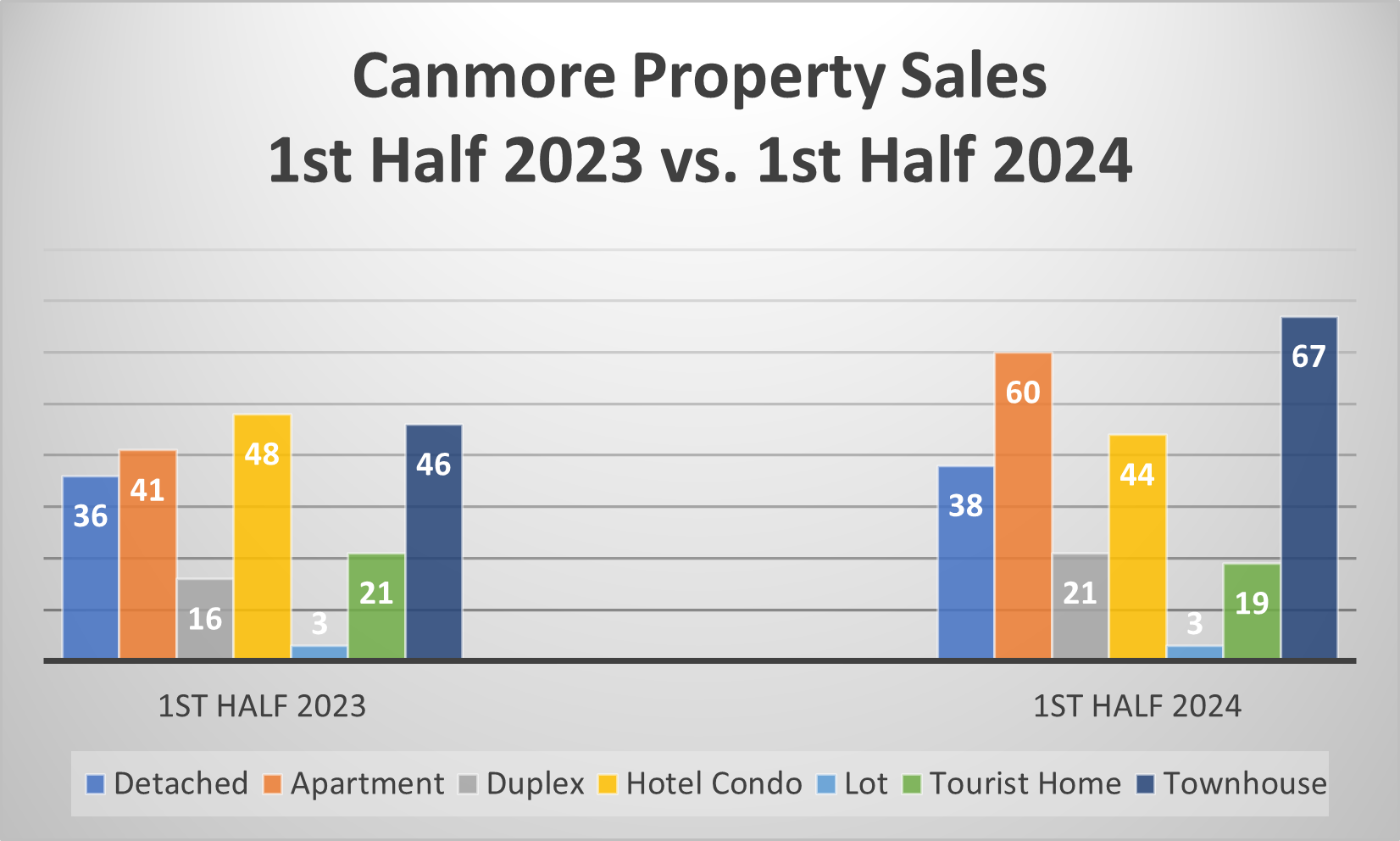

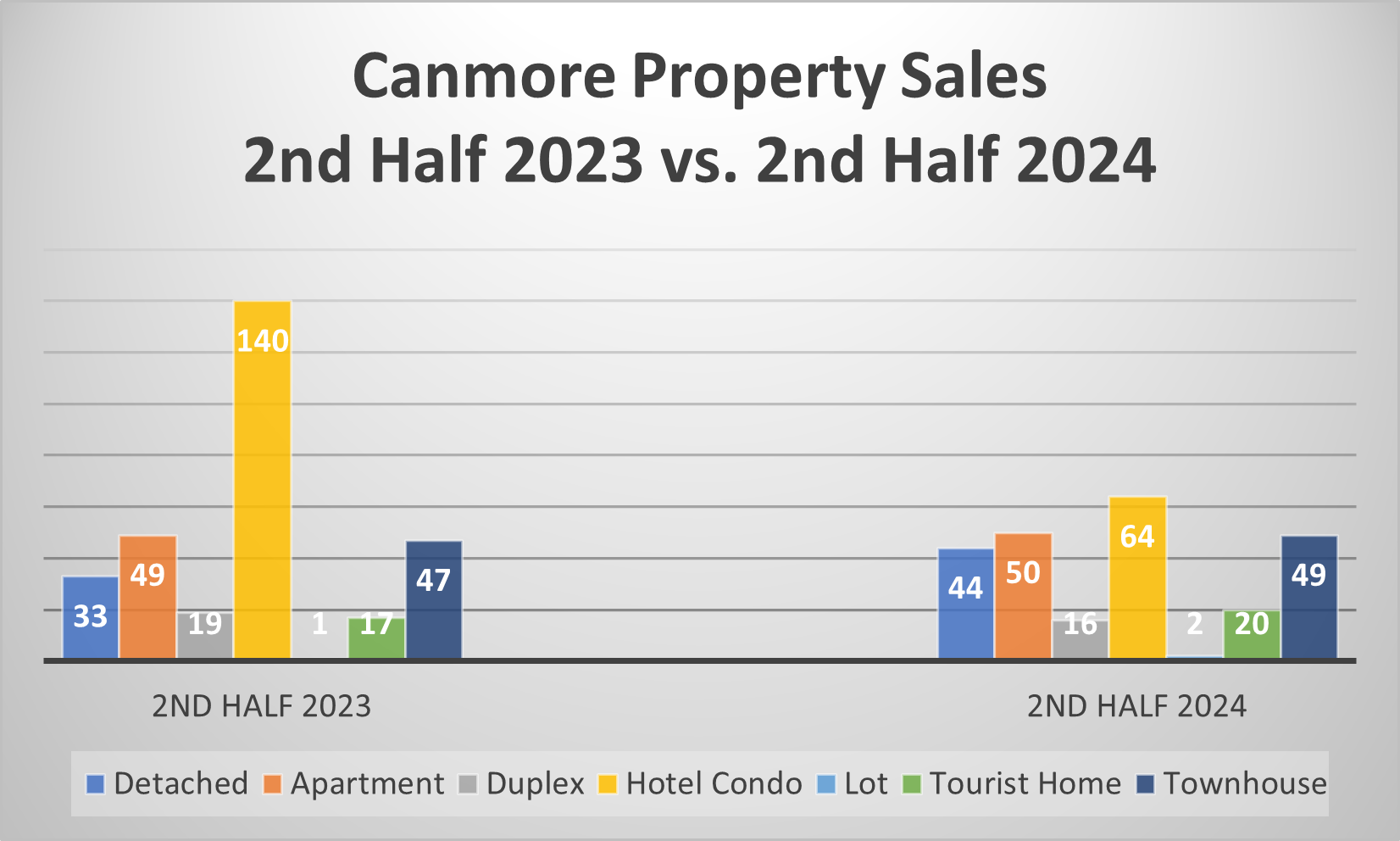

The following two charts reveal distinct trends in 2024. While sales in the first half of the year surged by 19% compared to the same period in 2023, the second half experienced a sharp 20% decline. This disparity is primarily attributed to the significant drop in Hotel Condo sales during 2024, as highlighted by the data.

Total Hotel Condo Sales 2023: 188

Jan-June: 48 resales

July-Dec: 45 resales plus 95 new developments

Total Hotel Condo Sales 2024: 108

Jan-June: 44 resales

July-Dec: 17 resales plus 47 new developments

Hotel condo sales dropped by a total of 80 units in 2024. Resales performed well during the first half of the year, with 44 units sold—comparable to the 48 sold in the same period in 2023. However, resale numbers significantly declined in the second half of 2024, with only 17 units sold compared to 45 in 2023, marking a 62% decrease.

Additionally, 95 new development hotel condos were sold in 2023, whereas only 47 were sold in 2024, with sales in both years occurring exclusively in the second half. This combined drop in resales and new development sales had a substantial impact on overall sales figures in the latter half of 2024.

In conclusion, excluding hotel condos from the analysis reveals an 18% increase in Canmore sales numbers from 2023 to 2024. Sales in the first half of the year show a significant 28% rise, while the second half records a more modest 9% increase.

The decline in hotel condo sales can be attributed primarily to high interest rates. These properties have seen significant appreciation since self-managing short-term rentals became a viable option, pushing prices to levels where achieving positive cash flow has become increasingly challenging. Combined with elevated interest rates, this has made investors more cautious. A few years ago, investing in a short-term rental property was a straightforward decision, but now, careful financial calculations are necessary. This scenario is likely to shift as interest rates begin to decrease.

Canmore’s strategic location between Calgary and Banff, coupled with its stunning natural beauty and proximity to Banff National Park, continues to attract a growing number of tourists each year. This trend is expected to persist, driving a steady demand for accommodations.

Over time, new hotel condo units are likely to be absorbed by the market, maintaining Canmore’s appeal as a strong investment destination. While appreciation in this sector may occur at a slower pace, the income potential remains promising. The key factor to watch will be the cost side—whether financing costs or unit prices decrease. Once these factors improve, this market segment is expected to regain momentum.

Key Insight: Excluding hotel condos, Canmore’s real estate sales actually rose by 18% in 2024, showing resilience in other property categories!

Inventory and Interest Rates

Listings

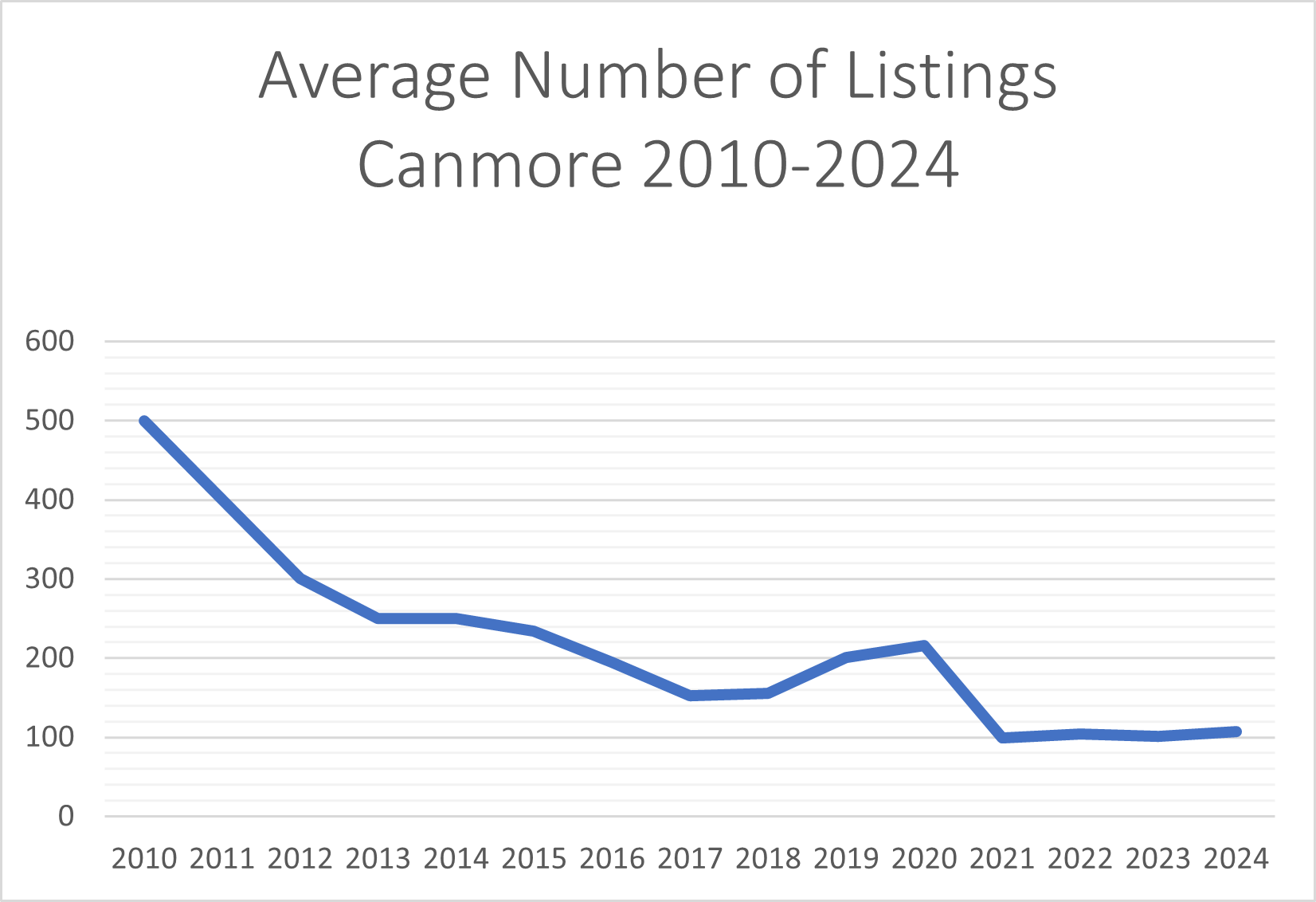

At the start of the year, there were a minimum of 75 listings, which gradually increased to a peak of approximately 130 in October. By the end of December, the number of listings had declined to just over 100. On average, there were about 107 listings throughout the year—a level that has remained consistent since 2021. With limited inventory available, many buyers remain on the sidelines, as reduced supply continues to exert upward pressure on prices.

Interest Rates

The Bank of Canada’s interest rate peaked at 5% in July 2023 but began to decline in June 2024, currently standing at 3.25%. The next rate announcement is scheduled for January, with further decreases anticipated. However, several factors could influence future rate adjustments, including inflation levels, broader economic conditions, potential tariff threats under a Trump administration in the U.S., Canada’s GST holiday, and newly implemented mortgage rules effective December 15th.

Given this environment, many potential buyers may be delaying their market entry in anticipation of even lower rates, contributing to weaker sales numbers in the second half of 2024. This trend suggests a possible surge in demand as interest rates continue to decline, potentially driving higher activity in 2025.

Price Analysis

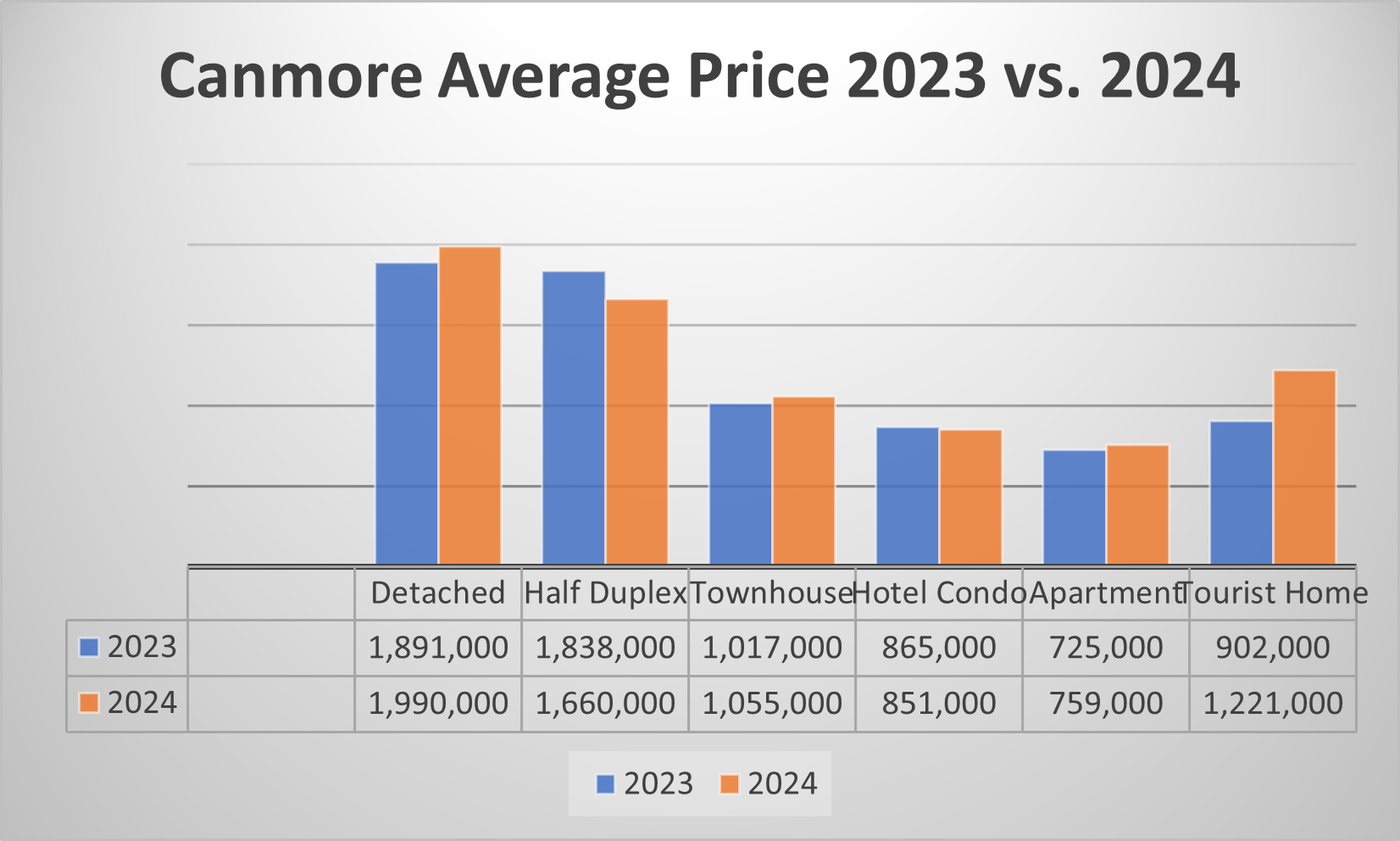

The average sale price for a Canmore Property increased by 7% from $1,087,000 to $1,166,000. The increase varies across different property types

The price/sqft on the other hand, decreased by 3% from $772 to $748.

When the average sale price increases while the price per square foot decreases, it indicates that the properties sold in 2024 were, on average, larger than those sold in 2023. This is confirmed by the data, showing an increase in the average property size from 1,408 square feet in 2023 to 1,558 square feet in 2024.

This discrepancy can largely be attributed to a significant decline in hotel condo sales, which typically have a higher price per square foot and are smaller compared to other property types. With fewer hotel condos in the sales mix, the average property size increased, while the overall price per square foot decreased.

Note that price/sqft increased for all property types except Hotel Condos and Duplex. 4.7% for Detached, 1.3% for Townhouses, 8.3% for Apartments and 14.5% for Tourist Homes.

Days on Market

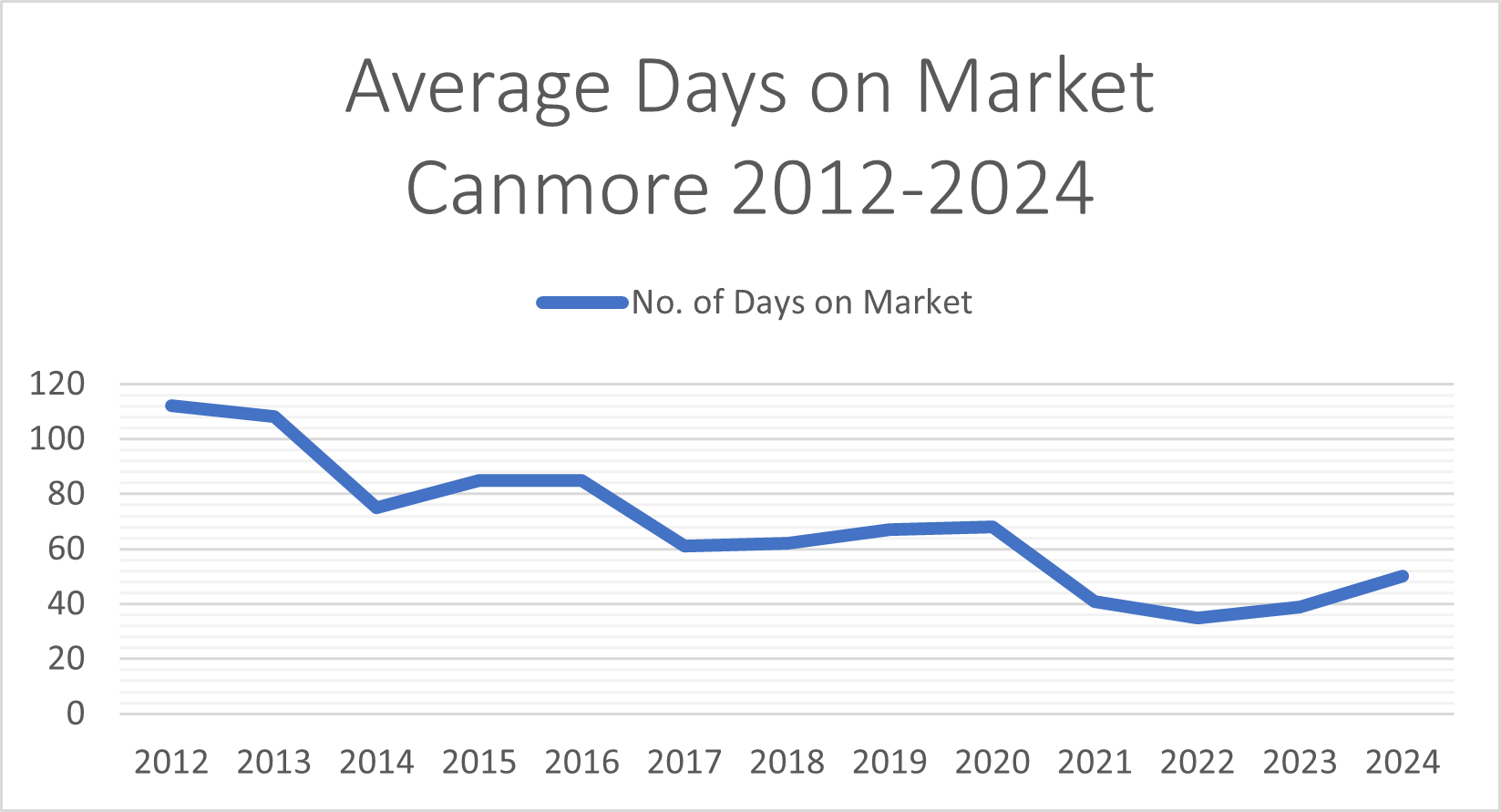

The average Days on Market, which measures the time a property remains listed before selling, increased from 39 days in 2023 to 50 days in 2024. This reflects a more cautious approach from buyers in the current market and a tight supply.

Summary

Sales:

Overall, sales numbers in 2024 have declined compared to 2023, but this is primarily due to a significant drop in hotel condo sales. Excluding hotel condos from the equation, total sales would in fact show an increase over 2023. Despite this, the second half of 2024 saw weaker sales across the board, with properties taking longer to sell, as average Days on Market rose from 39 days in 2023 to 50 days in 2024.

Key Drivers:

Interest Rates: Persistently high interest rates have made buyers cautious. Many are waiting for further rate reductions, which could encourage market activity as early as Spring 2025.

Limited Supply: With limited inventory, many buyers are struggling to find suitable properties. This supply challenge is unlikely to change significantly in the short term.

Pricing Trends:

Detached homes, townhouses, apartments, and tourist homes all experienced price increases in 2024, while hotel condos and duplexes declined in value. The average property price in Canmore rose from $1,087,000 in 2023 to $1,166,000 in 2024. However, the average price per square foot dropped from $772 to $748, due to the reduced volume of hotel condo sales, which traditionally have a higher price per square foot.

2025 Outlook - Factors shaping the market

Interest Rate Dynamics: Expected rate cuts in 2025 may unlock pent-up demand, spurring market activity.

Mortgage Reforms: New 30-year amortizations and increased purchase price limits for insured mortgages are anticipated to increase first-time home buyers’ affordability and access to the housing market. They could boost first-time buyer activity and new construction sales.

On September 16, 2024, the federal government announced changes to mortgage qualification rules for first-time home buyers, as well as those purchasing newly-constructed homes.

As of December 15, 2024 30-year amortizations will be available for all first-time home buyers, regardless of whether they have an insured mortgage. These extended amortizations are also available for any purchase of new construction.

The maximum purchase price for an insured mortgage (where less than 20% down is paid) will be increased to $1.5 million, from the current $1 million.

Canmore Vacancy Tax: The recently introduced vacancy tax may prompt some owners of second homes to list their properties for sale rather than incur the additional expense. However, its overall impact on the market is likely to be minimal.

Tourist Home Zoning and Taxation: Starting in 2025, tourist homes will no longer qualify for the residential tax rate, even if used for full-time living. Instead, all tourist homes will be subject to the higher commercial tax rate, regardless of their actual usage. While the town anticipates some owners may rezone their properties to residential to avoid the higher tax, such changes could result in a significant loss of value. As a result, it is unlikely that many owners will opt for rezoning.

Tourism and Growth: Canmore’s growing appeal as a tourist destination will sustain long-term demand.

Challenges

Inventory: Tight inventory may persist, limiting choices for buyers.

Inflation: Inflation levels, broader economic conditions, potential tariff threats under the Trump administration in the U.S.

Conclusion

Canmore’s real estate market remains robust despite challenges in 2024, driven by its unparalleled location and steady demand for mountain living. As interest rates ease and new policies take effect, 2025 promises renewed activity and opportunities for both buyers and sellers.

If you have any questions about this report or the Canmore real estate market, are curious about the current value of your property, or are considering taking your first steps into the Canmore market, feel free to reach out. I’d be delighted to assist you!

Stay informed, stay prepared, and let’s make the most of what Canmore has to offer in the year ahead!